Good morning,

This week, Kasi Insight highlights game-changing developments across Africa from Airtel Africa's partnership with SpaceX to bring Starlink internet to 14 countries, to fresh data on Danish business influence shaping regional economies. Our ESG webinar with Bayport unpacked why sustainability is now a business imperative, while top banking CMOs revealed how AI and real-time data are transforming marketing strategy. We spotlight a $28B opportunity in rethinking public holiday management and explore key 2025 consumer trends in Kenya, including eco-conscious spending. Finally, inflation stress intensifies in Ivory Coast, with food, education, and transport costs hitting households hardest. Stay informed, stay ahead.

Stay ahead of the curve.

Enjoy the read!

Media & Entertainment

By graphing the footprint of Danish companies in Africa, we gain valuable insights into the strategic decisions, regional focus, and the profound impact these entities have on the socio-economic fabric of the continent.

Development and impact

By graphing the footprint of Danish companies in Africa, we gain valuable insights into the strategic decisions, regional focus, and the profound impact these entities have on the socio-economic fabric of the continent.

ESG: More Than Buzzwords, It’s Business Survival

On April 29, we hosted our first webinar, “ESG Demystified: From Historical Roots to Future Opportunities,” featuring insights from Catherine Kameja of Bayport and Yannick Lefang of Kasi Insight. The session explored ESG’s evolution, sector-specific priorities, and the real-world challenges of implementation. Attendees walked away with clarity on why ESG is no longer optional but essential. If you missed it, don’t worry the webinar video will be available soon. Catch the slides here and stay tuned for the next session in our ESG series!

Turning Insights into Impact: How CMOs Are Redefining Banking in Africa

Discover how Africa’s top banking CMOs are harnessing data intelligence to shape impactful marketing strategies. At Kasi Insight’s recent event, industry leaders shared how real-time data and AI are driving decision-making, from understanding consumer confidence and spending behavior to leveraging digital banking growth. With exclusive insights from Yannick Lefang and Angelique Bennaars Libese, the session revealed how data-driven strategies are transforming boardroom conversations and boosting marketing success. Read the PR and book a free session now! Access the video

Public holidays are a vital part of culture and tradition but what if reimagining how we manage them could unlock $28 billion in economic potential? Our latest report dives into how smarter policy-making, digital tools, and better planning can reduce productivity slumps while respecting what matters most. It’s time to turn holiday slowdowns into strategic wins for Africa’s economy.

Download the full report to discover the solutions

Brands & Marketing

The State of Consumers in 2025: Trends, and Economic Implications

Kasi Insight’s latest State of the Consumer Report reveals the four game-changing trends reshaping Kenya’s consumer landscape in 2025. From intentional spending and digital-traditional blends to the rise of eco-conscious living, these shifts are redefining business strategy. Want the full scoop? Don’t miss out. Download a copy here.

How Human Connections Drive Consumer Behavior

On Valentine’s Day, Kasi Insight launched Hearts & Brands: The Power of Connection—a groundbreaking report revealing how love, communication, and relationships shape consumer behavior in Kenya. As brands navigate 2025, understanding these emotional drivers offers a powerful advantage in building deeper audience connections. Don’t miss out—get your copy today and unlock insights that can transform your strategy.

Finance

Inflation fatigue is deepening financial stress for consumers in Ivory Coast

Kasi Insight’s Cost of Living Tracker reveals that inflation continues to weigh heavily on consumers in Ivory Coast. With prices rising across key categories such as food, education, and transport, more consumers are feeling financially stretched, and stress levels are climbing across income groups and age segments.

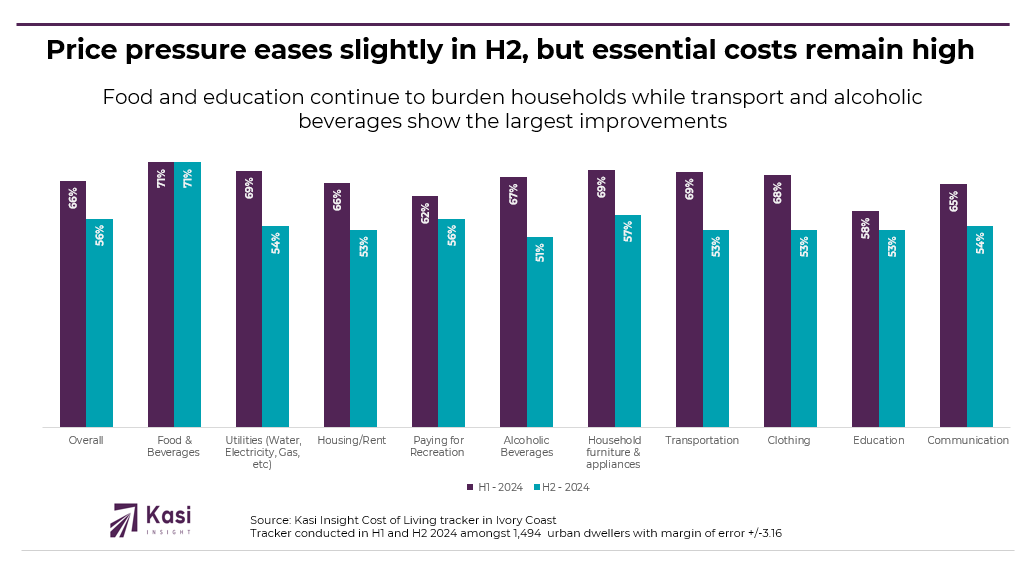

Food and education remain the most inflation-sensitive categories

By December, 77% of consumers reported that food prices had increased, up from 60% in March. This makes food the most significant contributor to inflation-related stress. Education costs also remain high, with 55% of consumers still reporting price increases at the end of the year. Transport has seen only minor improvement, with 56% of consumers citing price increases in December compared to 61% in March. These three essentials: food, education, and transport continue to strain household budgets the most.

Other categories have started to stabilize. Reports of utility price increases dropped from 63% to 54%, and 20% of consumers noticed a price decline, compared to just 9% in March. Communication followed a similar trend, with the share of consumers reporting price increases falling from 62% to 52%. Alcohol, clothing, and household goods also saw a slight easing of pressure, though concerns around affordability persist. Consumers are feeling the pressure most in areas they cannot avoid. Even where prices are stabilizing, cautious spending behavior continues.

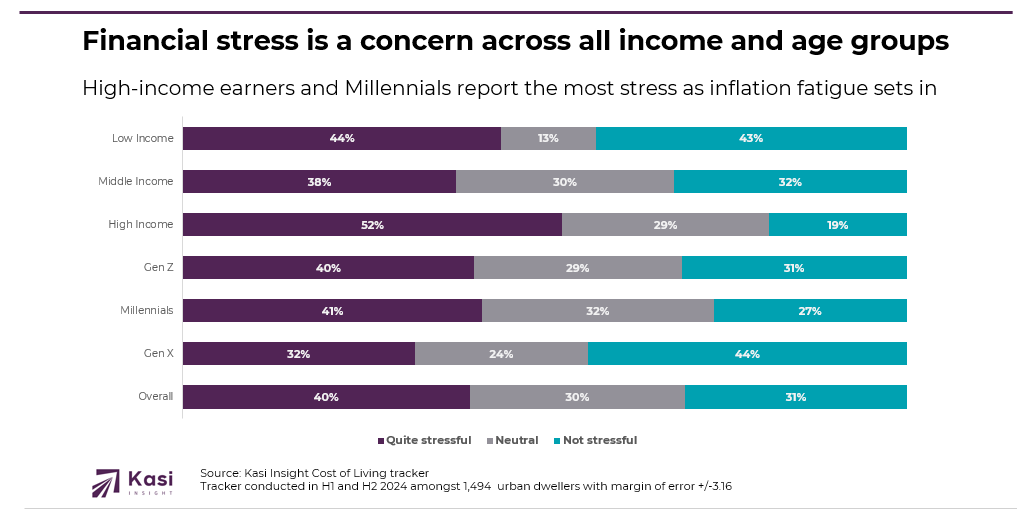

Millennials and high-income earners are reporting the highest levels of stress

Overall, 40% of consumers in Ivory Coast describe most of their recent days as quite stressful due to rising prices and financial issues. High-income earners are the most affected, with 52% reporting high stress and only 19% saying their days are not stressful.

Among age groups, 41% of Millennials say their lives feel quite stressful, followed by 40% of Gen Z. Gen X appears to be coping better, with 44% saying they are not stressed and only 32% reporting high stress.

Low-income earners show a split pattern. While 44% say they are quite stressed, 43% also report not being stressed at all. Only 13% describe their situation as neutral, indicating a polarizing experience where people are either managing or feeling overwhelmed. This shows that financial stress is not limited to any one demographic. Even groups traditionally seen as more financially secure are now experiencing strain.

Empathetic pricing and flexible options will be key to retaining consumer trust

With financial stress spreading across income brackets and generations, brands must adopt a customer-first mindset. In high-pressure categories like food, education, and transport, affordability must be central, via price adjustments, installment plans, or value bundles.

In improving sectors such as utilities, communication, and clothing, there’s room to rebuild engagement through loyalty programs, flexible payment options, and promotional campaigns. As some price sensitivity eases, the opportunity lies in communicating savings clearly and offering consumers a sense of regained control.

Empathetic, transparent, and practical messaging will resonate most. From Gen Z to high-income earners, consumers are not just looking for products, they’re looking for brands that understand their realities.

Contact our team today to explore how our economic intelligence can empower your decision-making process. Win with confidence with Kasi Insight. https://www.kasiinsight.com

Share on socials using this caption: 📈 Prices for essentials like food, education, and transport remain high in Ivory Coast, leaving 40% of consumers feeling quite stressed. 😓 Millennials (41%) and high-income earners (52%) are the most affected. 📉 While some relief is seen in utilities and communication, brands must respond with empathy 💬, flexible pricing 💸, and clear value ✅. #CostOfLiving #ConsumerStress

Joy Muindi

Kasi Academia

How Kasi Helped a Graduate Student with African Data: Unlocking Research Potential with Kasi Academia

Access to reliable African data has long been a challenge for researchers. In 2025, Kasi Academia changed that by empowering a graduate student with real-time, localized insights for their research. With 70M+ data points, 600+ datasets, and AI-powered analytics, they were able to transform their thesis with accurate, Africa-focused intelligence bridging the research gap and driving meaningful impact. Data should fuel discovery, not hinder it. Kasi Academia ensures that students, academics, and institutions win with confidence by providing the right insights at the right time.

Watch the full webinar here & Join Kasi academia here.

ICYM

The Shifting Center of Confidence: Why Global Stability Needs More Than One Anchor

Kasi Maps - Who really controls Africa’s cross-border narrative?

Kasi Insight and Moonlook Forge Strategic Partnership to unlock Africa’s Creative Industries

Kenya’s Central Bank is cutting rates, but recovery still needs stronger momentum

54% of Africans back Trump but many are now prioritizing Africa’s interests